Written in collaboration with Katie Corbett

Insurance programs such as the Affordable Care Act have attempted to implement an equitable approach to health insurance offerings. Medical professionals, especially those who own small practices and have fewer than 15 employees, have been left behind in insurance initiatives. Dr. Noor Ali, MD, MPH, CPH, is actively working to change that. She works to educate medical professionals on the insurance industry, so they can make informed decisions.

Here are five terms she says are helpful to understand when you are shopping for health insurance. These are the top five terms you need to know to successfully navigate the healthcare marketplace.

1. Premium – The monthly payment that you have to pay to have the policy. This is typically due at the same time each month for as long as you have the policy. Most companies have a 30-day grace period if you are late on a premium payment. It’s usually best to have your health insurance premiums auto-deducted from your paychecks or on some kind of auto-payment. That way, if you are ever late on a payment, or your credit or debit card expires or gets lost or stolen and you happen to need emergency medical services, you won’t be stuck without health coverage.

2. Deductible – This is the amount of money you have to pay out of pocket in full medical costs before your insurance company will pay out benefits according to your policy. Deductibles vary from plan to plan. Higher deductible plans can have lower premiums, but not always, so be aware of your plans’ premiums and deductibles. A very common misconception, especially among younger generations, is that the younger and healthier they are, the higher deductible plan they should be on because they hardly ever use their plan or get sick. It could mean that they are paying into a health insurance plan that they hardly get to utilize until an unlikely high deductible is met. Reasoning that works for your home and auto insurance might not make sense for your health insurance.

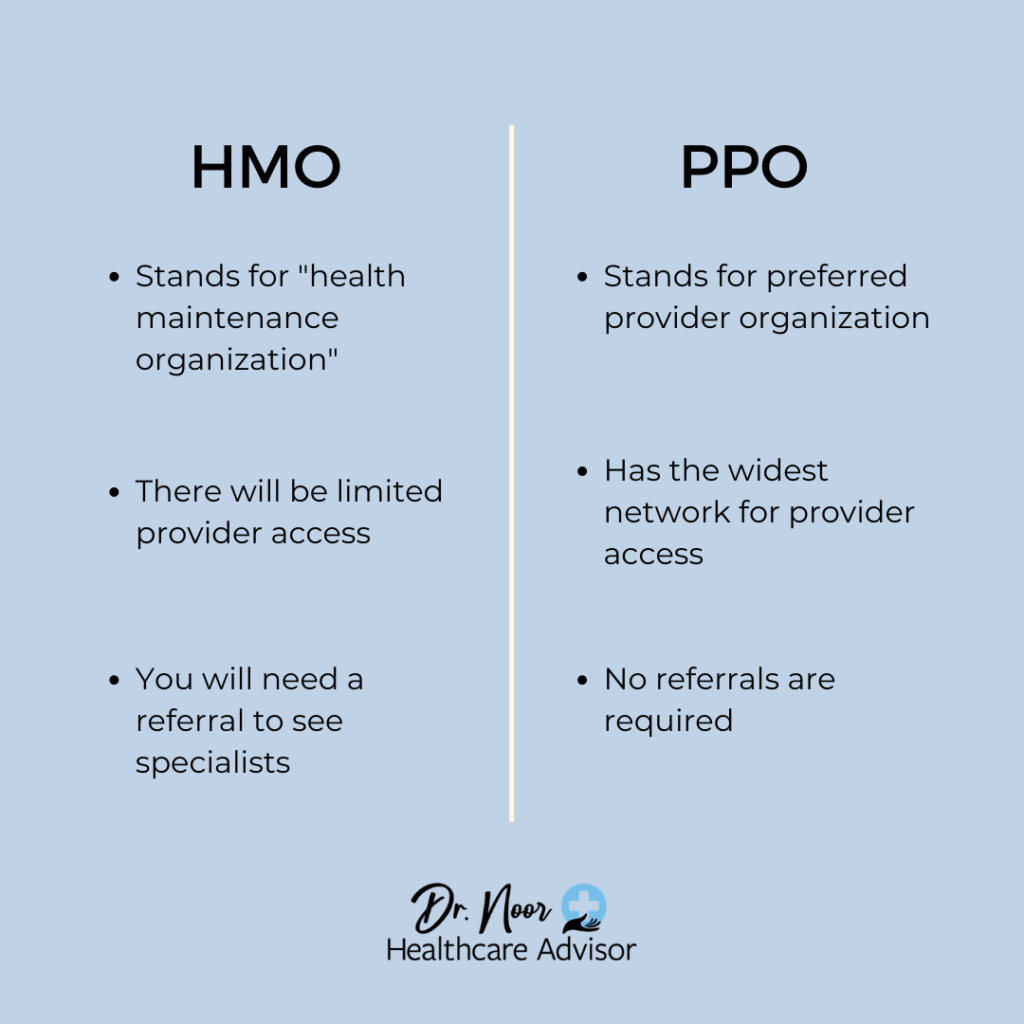

3. Network – Your health insurance network dictates which doctor, provider, hospital and medical centers you can go to that will accept your insurance plan. Typically, the three main types of networks are Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Exclusive Provider Organization (EPO). A PPO network is nationwide; it is the largest type of network and crosses state lines for coverage. It’s a good idea to look up your preferred doctor or provider before signing up for an insurance plan to confirm that they are in-network and will accept your insurance.

4. Co-pays/Co-insurances – This is the amount of money you have to pay BEFORE you are able to get your medical service. Co-pays are usually fixed-dollar amounts whereas co-insurances are a percentage of your total billed charges for medical services rendered

5. Maximum-out-of-pocket – The most you will have to pay out of pocket for your insurance plan before an insurance company will step in and cover the rest of your medical bills. Different carriers may have different definitions and clauses and riders that go into determining this amount. Be mindful of limitations and exclusions.

When evaluating whether or not an insurance plan is right for you, it’s important to consider these points so you can compare apples to apples. All insurance plans are not the same and each policy is created with many layers of coverage containing riders, limitations and exclusions. It can be a lot to keep in mind while picking the best coverage.

“Doctors need to learn a lot about the insurance industry in order to choose their plans,” Dr. Ali says. “They may not always make the best decisions. Most of the time, this is due to a lack of information available to them. I want to help cut through the noise and help doctors make decisions that are best for them.”

Residing in Westchase,Tampa, Dr. Ali is a first time mom, and big supporter of mom-preneurs in science and leadership. She is a licensed health insurance advisor contracted with USHealth Advisors and holds a 2-15 license in more than 30 states. She loves connecting with professionals everyday to help shed a bit more light on how they can be on a better health plan and optimize their coverage.

Book a call with Dr. Noor for a consultation on the best fit health plan for you.

Book a call with Dr. Noor for a consultation on the best fit health plan for you.